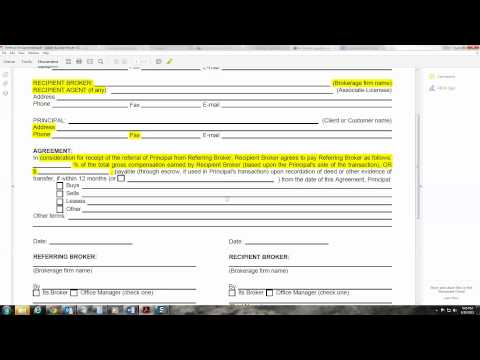

Hello there, Shawn Allen! I am your productivity coach at the Market Center. I hope you are doing well. Alright, let me show you how to fill out a referral fee agreement. But first, a bit of backstory. If you have the opportunity to refer to another Market Center, here's what I suggest you do: make contact with the client and build some rapport and relationship. Conduct a brief needs analysis. Once you've done that, assure them that we have a great team of professionals ready to help them. I will take this information and ensure that you are connected with the right professional. Now, let's discuss how you can look for professionals in that particular market area. There are several ways to do this. You can go online and search for the Market Center's contact information or reach out to the team leader. You can also join the KW referral group on Facebook or contact me, and I can help connect you with other productivity coaching agents across the country and in different markets. Once you have identified a suitable person, it is important to have a conversation with them to ensure that you are on the same page. They should be willing to communicate with you and provide the necessary information for the referral fee agreement. Now, let's talk about the steps to fill out the referral fee agreement. If you are the referring broker, meaning you are sending the referral, fill out the information in the designated spot. If you are the recipient broker, meaning you are receiving the referral, fill out the information in the assigned area. Make sure to complete all the required fields. Provide the principal's information, which includes the client's details. Fill out the appropriate information regarding the percentage of the referral fee,...

Award-winning PDF software

Paying Referral fees to individuals Form: What You Should Know

You may be entitled to a referral fee from your clients based on: 1. The number of transactions the client made with you, and/or 2. The number of times you refer new clients to the client. Revenue Sharing and Referral Fees: What You Need to Know REVENUE SHARING REFERRAL FEES—The “FREAK” — Blogger Jan 9, 2025 — Referral fee and profit sharing are common practices for companies in the field of business. The goal and reason, for REFERRALS — What You Need to Know REVENUE SHARING REFERRAL FEES —The “FREAK” — Business 2 Jul 18, 2025 — The best practices of revenue sharing, referred by the IRS, apply to a company doing any type of business which consists of referral fees paid to a referrer. Example is when a company pays the manager a referral fee for being able to send that manager to your company. Referral Fees: What You Need to Know REVENUE SHARING REFERRAL FEES —The “FREAK” — Blogger Jul 19, 2025 — Referral fees are commonly offered for “revenue sharing”, and are generally calculated as a percentage of the gross dollar amount. However, there are special situations in which this payment may differ — Blogger REVENUE SHARING — The “FREAK” — Blogger Jul 22, 2025 — What is revenue sharing? Referral fees are usually calculated on a percent of a transaction's value, meaning 500 might be charged as a referral fee for the same 500 in transaction fee. This is an issue for some companies in the field of business. Referral fees, according to the IRS will be considered a “service” as part of the tax code, and can be taxed under income tax codes as a “revenue-sharing payment “, even though there is no direct payment. Revenues-Share payments are different from direct payments (with a cashier's check). Revenues-Shirking payments are not considered to be “revenue-sharing payments”. To claim royalties from a revenue-share payment, the following documentation must be provided to the IRS: 1. A written description of each transaction that included revenue. 2. The total of each transaction that included revenue. 3.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do agentMapIt Real Estate Agent Referral Form, steer clear of blunders along with furnish it in a timely manner:

How to complete any agentMapIt Real Estate Agent Referral Form online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your agentMapIt Real Estate Agent Referral Form by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your agentMapIt Real Estate Agent Referral Form from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Paying Referral fees to individuals